“You can open the champagne now.”

Joyful celebration lit up online groups for creditors of the bankrupt MtGox exchange on June 22, when a Japanese court decided to move the company into “civil rehabilitation,” a new legal process that promises to deliver a windfall of bitcoin for creditors.

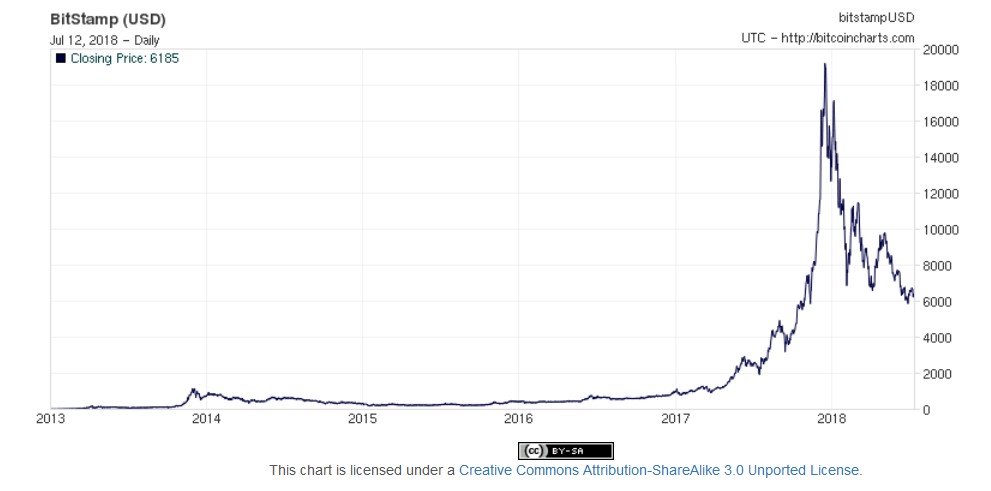

It’s spectacular news for the 24,750 approved MtGox creditors, because based on today’s bitcoin value they will end up with more money that they actually had at the time MtGox went into bankruptcy. The original bankruptcy proceeding, by law, would have paid creditors just $483 per bitcoin—the value when MtGox went bankrupt in 2014. Under civil rehabilitation, they will receive bitcoins, which are now trading at around $6,000 each, plus their share of whatever cash remains in the MtGox estate. While they missed out on the peak price of almost $19,000 last December, this is still more moolah than they ever dreamed back in 2014.

“This is the best news in this case since years,” wrote one man on the MtGox Creditors Telegram group, just after someone posted the MtGox trustee’s June 22 announcement that the Tokyo District Court approved MtGox’s move.

But a more tempered response came from Josh Jones, CEO and founder of Bitcoin Builder Inc., whose claim towers at 43,768 bitcoins—though he’s quick to point out some belongs to him, and some to his site’s users. Jones’s group is the second-largest MtGox creditor, right behind New Zealand’s bankrupt Bitcoinica exchange with 64,673 bitcoins.

Under the bankruptcy, Bitcoin Builder’s claim—just the bitcoin portion—was worth $21.14 million; 43,768 bitcoins times 2014’s value of $483 per bitcoin. Under civil rehabilitation, if they recover the estimated 21 percent of their claim—or 9,191 bitcoins—it would be worth $56.89 million at today’s price of $6190. Throw in another 10% or so, which is about the going rate for the Bitcoin Cash that will have accumulated after the fork, and we could estimate Bitcoin Builder’s total recovery at roughly $61 million, at today’s prices. But Bitcoin’s wild ride so far gives little indication of what the valuation will be at the time of the eventual settlement.

“The day actually I can take the bitcoin and Bitcoin Cash into my own private wallet—that will be good. Until then, don’t count your chickens before they hatch,” said Jones.

As the dust settled on the celebrations, Jones’ wary pessimism made more and more sense. It emerged that all claimants will have to start over and re-file in the new civil rehabilitation proceedings. Adding insult to injury, when creditors attempted to log on to the MtGox bankruptcy claims system, they were greeted with an error message, even though the bankruptcy trustee had announced he was taking the system offline and would relaunch it for filing the new civil rehabilitation claims.

“When there is uncertainty, people imagine the worst-case scenario,” said one New York-based creditor who asked to be anonymous because he fears people might target him because of his nearly 700-bitcoin claim, which could net more than $1 million. He had a message for his anxious peers: “Let’s hold our horses.”

Aside from jotting down some important deadlines, creditors only need to do one thing right now: Keep calm and wait for news from MtGox trustee Nobuaki Kobayashi, a bankruptcy lawyer at the Japanese firm Nagashima Ohno & Tsunematsu.

From Jan. 31, 2019 to Feb. 7, 2019, Kobayashi will examine proof of re-filed claims to check if they really exist, and in the proper amounts. By Feb. 14, 2019, Kobayashi will file a proposal for the civil rehabilitation plan—this will state the payment plan, and also whether he’ll pay people using bitcoin rather than fiat. The court has already appointed an examiner—Japanese lawyer Hisashi Ito—who will look over the plan and report to the court. If the court rejects this plan, MtGox will go back into bankruptcy.

Kobayashi sold off large chunks of bitcoin and bitcoin cash between December 2017 and February 2018, which created panic among creditors and in the broader cryptocurrency markets. He placed the cash from the sell-offs in a trust in the bankruptcy estate, and explained that he plans to use the funds to secure the interests of creditors with fiat claims.

Kobayashi hasn’t said yet if he’ll pay creditors in bitcoin and Bitcoin Cash, or fiat, but the answer will come in the February 2019 civil rehabilitation plan.

MtGox ex-CEO Mark Karpeles, who lost more than 50 pounds during his stint in a Japanese jail last year, and who’s admitted mistakes in his handling of MtGox’s downfall (“The methods I chose to try to get MtGox out of its trouble ended up being insufficient, insufficiently executed, or plain wrong,” he wrote) is still facing charges of embezzlement and data manipulation. Prosecutors have alleged he embezzled ¥341 million. He maintains he’s not guilty, and his criminal trial is still ongoing. If convicted, he could get up to 10 years in prison.

Karpeles has said he doesn’t want to make money from the company’s bankruptcy, and wrote on Reddit that he’ll keep cooperating with authorities during the civil rehabilitation process. He declined through a spokeswoman to answer questions for this article.

“Although it is unknown yet if it will bring everything creditors have been hoping for, civil rehabilitation has much more chances of bringing a positive outcome to all past MtGox customers (including those who failed to file claims before) than bankruptcy,” he wrote.

Creditors had been shocked and dismayed in the fall of 2017 when it became clear that their bitcoin claims would be paid at 2014’s value of $483 each, as the price of bitcoin last year ranged roughly between $2,500 in October and $17,000 in December of last year.If MtGox’s estate had paid its creditors according to the bankruptcy deal, they’d have had about $2 billion in assets left over. Where would that money go?MtGox’s shareholders—mostly a single 88 percent shareholder, Tibanne, owned fully by Karpeles—would get the surplus. Creditors went wild at the news: the man responsible for MtGox’s downfall would emerge from the fracas a billionaire. Petitioners swarmed the court to move the company back into civil rehabilitation, so that all of the assets would go to the creditors, leaving nothing for Karpeles.Even Karpeles agreed.“I don’t want this. I don’t want this billion dollars. From day one I never expected to receive anything from this bankruptcy. The fact that today this is a possibility is an aberration and I believe it is my responsibility to make sure it doesn’t happen,” he wrote on Reddit.

The court’s decision actually brings MtGox full circle.

MtGox went dark in late February 2014. 750,000 bitcoins from user accounts and 100,000 of MtGox’s bitcoins had disappeared from the exchange. A month later, then-CEO Karpeles located 200,000 of the lost bitcoins when scanning an old-format wallet, bringing the company’s assets to 202,206 bitcoins.

Explaining the loss at the time, Karpeles claimed someone had illegally moved bitcoins by abusing “a bug in the Bitcoin system” that caused incomplete bitcoin transfer transactions. We now know this is not true: Actually, hackers compromised MtGox’s servers and siphoned off hundreds of thousands of bitcoins over a period of three years.

In its first filing for civil rehabilitiation, the company reported $3.84 billion in assets and $6.5 billion in liabilities.

Suspicions of complicity in the massive heist swirled around Karpeles himself until last July, when Russian national Alexander Vinnik was indicted by a California grand jury and taken into custody in Greece; the U.S. government is seeking to extradite him to face criminal charges linked to the MtGox hack and other shenanigans.

Between September 2011 and May 2014, Vinnik and his co-conspirators at BTC-e, a crypto exchange allegedly stole 530,000 bitcoins; three BTC-e accounts got 300,000 bitcoins and the rest went into digital wallets through the now-defunct Tradehill exchange, and into MtGox wallets controlled by Vinnik’s account. Bitcoins were exchanged into fiat currency and sent to Vinnik’s bank accounts.

Vinnik and BTC-e, a crypto exchange he allegedly operated, were busted for operating an unlicensed money service business and conspiracy to commit money laundering. Vinnik faces additional charges of 17 counts of money laundering and two counts of engaging in unlawful monetary transactions. If convicted of all counts, Vinnik could get 385 years in prison and a fine of $10 million or more. BTC-e also faces a $110 million civil money penalty and Vinnik faces a $12 million civil penalty.

In response to the allegations, one of Vinnik’s lawyers in Greece, Ilias Spyrliadis, wrote in an email that Vinnik wasn’t involved in the MtGox story and his “only relation is that BTC-e was one of our clients to which we were providing services.”

Kim Nilsson, founder of WizSec, who has spent years exhaustively researching the MtGox heist, explained that the main theft happened in September 2011 when a thief stole or copied the bitcoin wallet—with all the private keys securing ownership of the bitcoins inside—from MtGox’s main server.

“The thieves then proceeded to move any MtGox bitcoins they had access to—mostly sending them to Alexander Vinnik—a process which continued for several years as over time additional funds kept being deposited into the same compromised private keys,” Nilsson wrote, noting that MtGox had scant bitcoin monitoring procedures. “It seems very likely most or all of the bitcoins would have long since disseminated back into the ecosystem, making it impractical or impossible to achieve any kind of recovery.”

He noted that he hasn’t seen evidence of who the actual hackers or thieves are and he couldn’t speculate about whether law enforcement would successfully prosecute them.

“People haven’t stopped looking, though,” Nilsson added.