In the course of researching NFTs a bit for a piece last week (‘The Art World Was Broken Before NFTs‘) I started catching up on crypto trends, which had whooshed far beyond my ken since the Civil project cracked up a couple of years ago. I still believe wholeheartedly in the potential of true, distributed public blockchains to secure speech rights and press freedom (and tons of other things), but the profiteering and chicanery that have sprung up around blockchain since I first became interested in 2011 or so have been a real bummaire. Plus I’ve been super absorbed in helping build the Brick House Cooperative.

Happily, though, I found there are a lot of good new developments in cryptolandia, in particular with respect to the progress of proof of stake. I was especially glad to find that @el33th4xor—elsewhere known as Cornell computer science prof and long-trusted crypto authority Emin Gün Sirer—has built a promising PoS project (and no, I haven’t invested in it yet and please note, none of what I am writing here should be construed as advice or investment advice of any kind, crypto can be dangerous, be careful etc.)

SO.

One of the most interesting things I learned will be of particular interest to anyone who ever (ever ever) bought or sold CVL tokens in late 2018-early 2019, when it became possible to buy them, trade them for ETH, and, very briefly, to use them on the short-lived Civil Registry to stake journalism projects.

Please bear with me for a little context here.

Because no crypto exchange handled CVL, it was necessary back then to make use of Uniswap, an automated market maker and early entrant in the world of decentralized finance (DeFi), in order to trade. Uniswap has grown quite a lot in the years since, to become one of DeFi’s largest projects. Then, last summer, a competitor to UniSwap called SushiSwap emerged. SushiSwap very rapidly threatened to eat the lunch of Uniswap by (among other things) offering participants a share of transaction fees through its own SUSHI token.

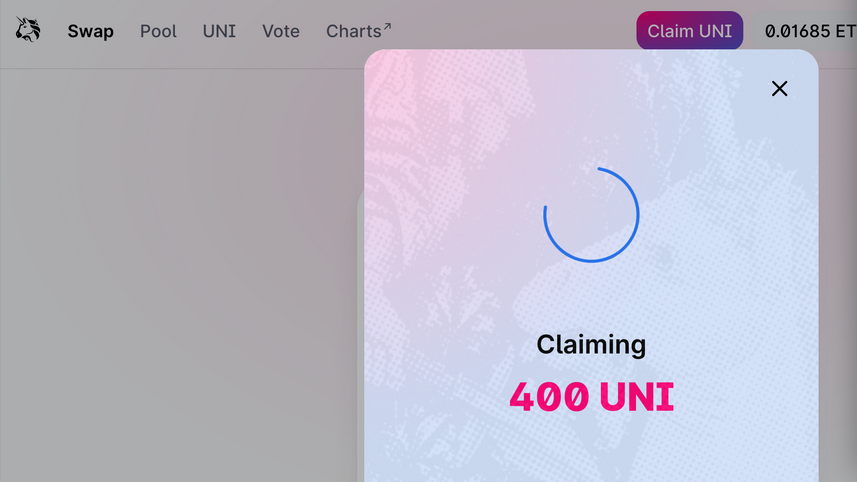

Alive to the immediate threat posed by SushiSwap, Uniswap launched a token of its own last September, the UNI token. And in order to compete with SUSHI, Uniswap decided to send 400 of these new UNI tokens as an “airdrop” to every single address that had ever used their service.

This means that if you ever exchanged CVL tokens for ETH, or (I believe) vice versa—if you were ever compensated in CVL and liquidated even a little bit of it for ETH—each ETH wallet you used for trading CVL now contains 400 UNI tokens, which have appreciated very substantially since the time of issue, and are worth roughly $12,000 at the time of writing.

(Is this for real, yes it is, I know because I collected 400 UNI myself last week.)

In order to collect the UNI tokens, if you are eligible:

- Log in to MetaMask

- Open the MetaMask wallet you used for buying or selling CVL tokens

- Visit https://uniswap.org

- Connect your wallet to claim tokens (there’s a button in the upper right corner)

- p.s. you will need like $40 or $50 worth of ETH in the wallet in order to process the claim

- p.p.s. UNI tokens trade on Coinbase, so if you obtain a UNI wallet in your Coinbase account you can convert to cash or other crypto there

Let us know how it goes in the comments! And don’t forget to subscribe and/or donate to The Brick House.