IN SAN FRANCISCO today, Elon Musk entered his third day of testifying to defend himself in a securities-fraud lawsuit revolving around his decision to tweet, in 2018, “Am considering taking Tesla private at $420. Funding secured.” Musk did not, in fact, take Tesla, Inc. private—it remains TSLA on the Nasdaq—and the judge has already ruled that Musk was expressing a reckless falsehood when he wrote “Funding secured,” and likewise when he followed up by tweeting “Investor support is confirmed.”

Also Musk has now declared, under oath, that, contrary to public consensus, he was not at all making a weed joke when he set the imaginary price for his non-secured deal at $420.

Whether that turns out to be true or not, it is a reminder that there was a time—less than a year ago!— when it seems that $420 was, in fact, a plausible share price for TSLA. Then there was a time, about three weeks ago, when the plausible share price for TSLA was $300 below that point, and plunging.

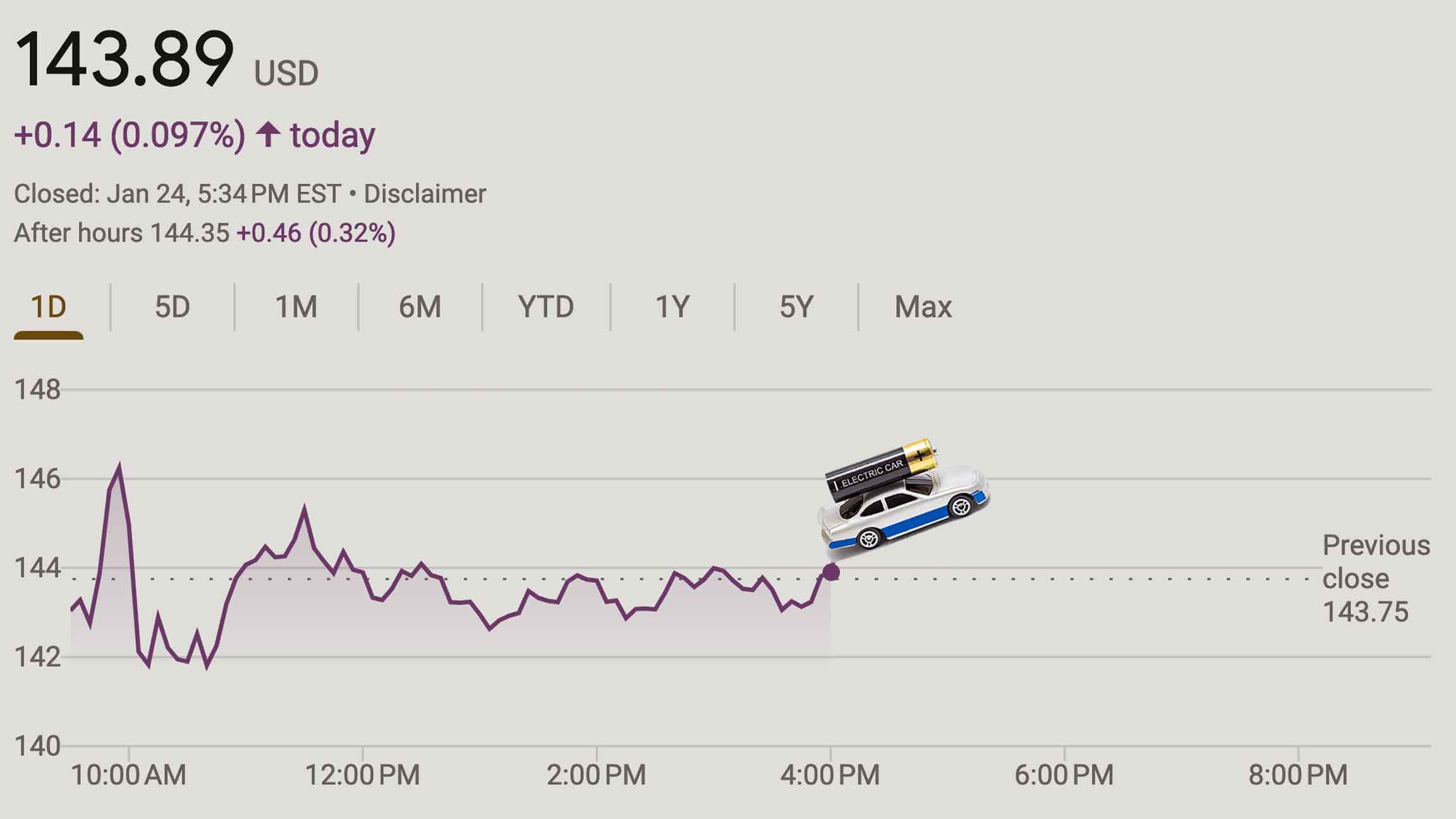

And now? With the CEO facing a jury over fraud claims and with an earnings announcement due tomorrow, Tesla’s investors treated this week more or less exactly like they treated last week. Last Tuesday, after two weeks of solid climbing, TSLA closed at $131.49. Since then, its upward march has continued, reaching $143.89 by today’s close.

The $12.40 that a share of TSLA gained since last Tuesday would have been enough to buy any of the following:

• 1.2 kilometers of red synthetic twine

• 8 pieces of tumble-polished smoky quartz (extra small)

• 6 tire valve stem extensions for 1975 Ford automobiles

• 10 brown plastic buttons (size 24L)

• 100 1 3/4 inch steel melamine screws, with plastic caps

• 1 chrome Syracuse Orange license plate frame

Thank you for visiting POPULA! Add your email here to receive our newsletter!